green card exit tax calculator

Green Card Exit Tax Abandonment After 8 Years. For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000.

Will You Pay A Us Exit Tax Because Of Your Green Card

The us has enacted an exit tax that prevents us.

. Green Card holders who have lived lawfully in the US for eight out of the last fifteen years may be subject to the exit tax regardless of their income net worth or filing compliance. And if you trip any of these tests you should calculate the exit tax. Not everyone is taxed.

Exit tax is calculated using the form 8854 which is the expatriation. How the Exit Tax is calculated in general what is subject to the Exit Tax. When a person is a covered.

For married taxpayers each spouses net worth is calculated separately from the other. Citizen or Green Card holder ARE. Green card exit tax rate.

Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued. The mark-to-market tax does not apply to the following. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them.

Government revokes their green card visa. Green Card Exit Tax Amount. Citizens who have renounced their.

AFTER becoming a US. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable. Permanent residents and green card holders are also required to pay taxes.

It is not just your US. In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue Code Section 877A which applies to certain US. Green Card Exit Tax Calculator.

This is the aggregate net value of worldwide assets. Exit tax applies to. Pensions earned OUTSIDE the US.

The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. Giving Up Green Card Exit TaxThe expatriation tax provisions under internal revenue code irc sections 877 and 877a apply to us. This in turn requires either an administrative or judicial determination.

To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or.

Green Card Exit Tax 8 Years Long Term Residents Expatriation Permanent Residents Us Exit Tax Youtube

How Not To Pay Taxes Four Legal Ways To Not Pay Us Income Tax

Do Green Card Holders Living In The Uk Have To File Us Taxes

The Truth About Ssn Giving Up Us Citizenship Us Expat Tax

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Expatriation Critical Financial Planning And Tax Considerations For U S Citizens And Green Card Holders

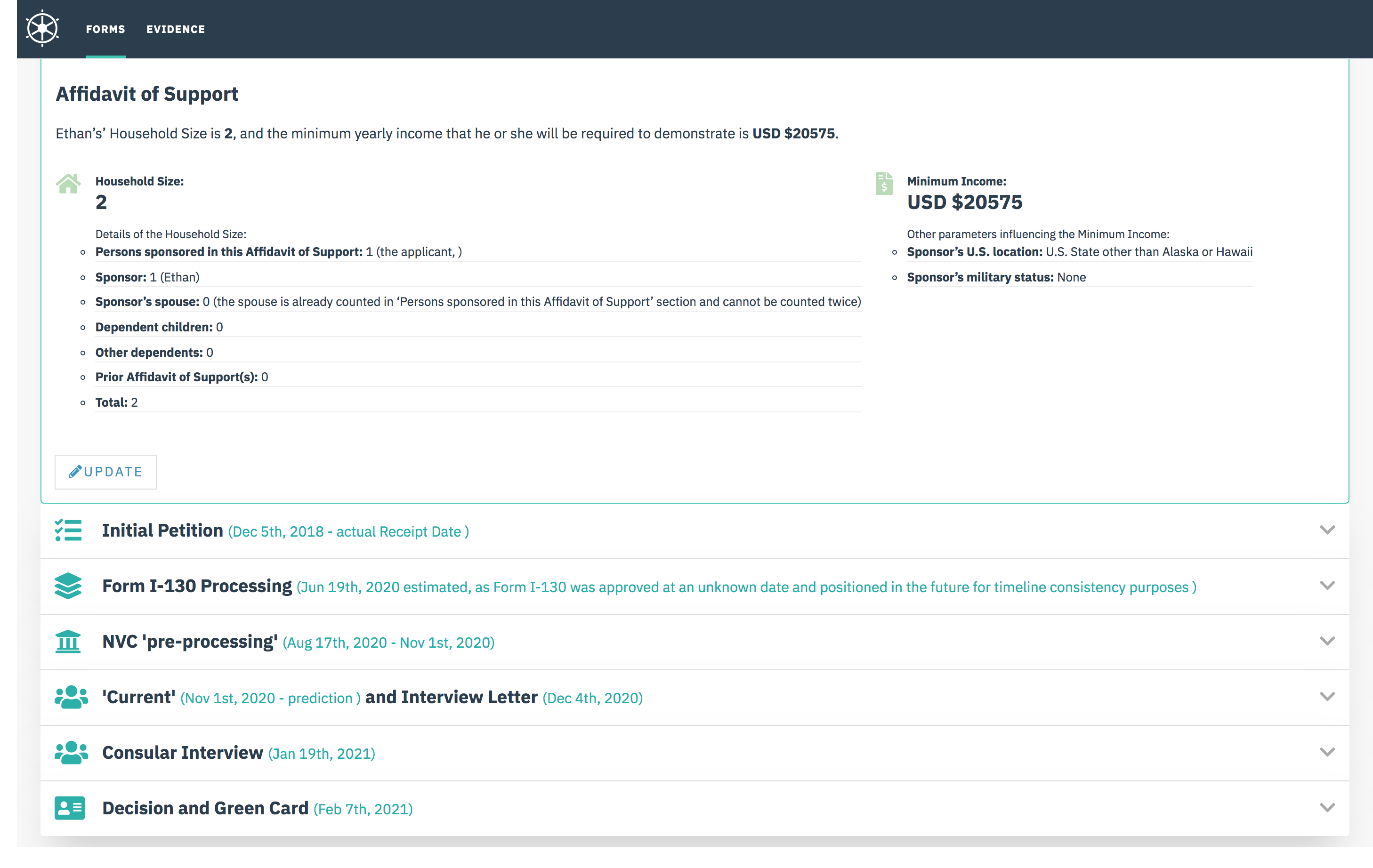

Affidavit Of Support For Green Cards Immigration Planner

G4 Visa Holders And Us Tax Residency Issues The Wolf Group

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Mortgage Calculator Estimate Your Monthly Payments

Calculator Need To File Us Expat Taxes Myexpattaxes

Watch Out The Exit Tax Before Giving Up Your U S Citizenship Or Green Card X And Y Advisors Inc

Once You Renounce Your Us Citizenship You Can Never Go Back

Amazon Com Texas Instruments Ti 30x Iis 2 Line Scientific Calculator Lime Green Scientific Calculator Office Products

Us Exit Taxes The Price Of Renouncing Your Citizenship

The Green Card Renewal Process Explained

When Might Renouncing Us Citizenship Make Sense From A Tax Point Of View